A Guide to Government Retirement Benefits in Canada: OAS, CPP, and GIS

Retirement Planning

A Guide to Government Retirement Benefits in Canada: OAS, CPP, and GIS

Ali Ladha, CPA, CA / September 15, 2025

Planning for retirement in Canada isn’t just about how much you’ve saved, it’s also about understanding the government programs designed to support you. Three of the most important benefits are:

-

- Old Age Security (OAS)

- Canada Pension Plan (CPP)

- Guaranteed Income Supplement (GIS)

Each of these programs works differently, with unique eligibility rules, income tests, and strategic choices. Let’s break them down so you can see how they fit into your retirement plan.

Old Age Security (OAS)

OAS is a monthly payment funded by the government. OAS is not funded via your personal contributions. OAS is universal i.e. it is received by all Canadian retirees, but high-income retirees may lose some or all of it.

Key facts:

-

- Eligibility:

- Available to most Canadians at age 65, provided you’ve lived in Canada for at least 10 years after age 18. To receive the full benefit, you generally need 40 years of residency.

- Enrollment:

- If you’ve filed taxes consistently, you’re often enrolled automatically. If not, Service Canada may require you to apply.

- Amount (2025):

- About $713/month for those 65–74, slightly more after 75.

- Eligibility:

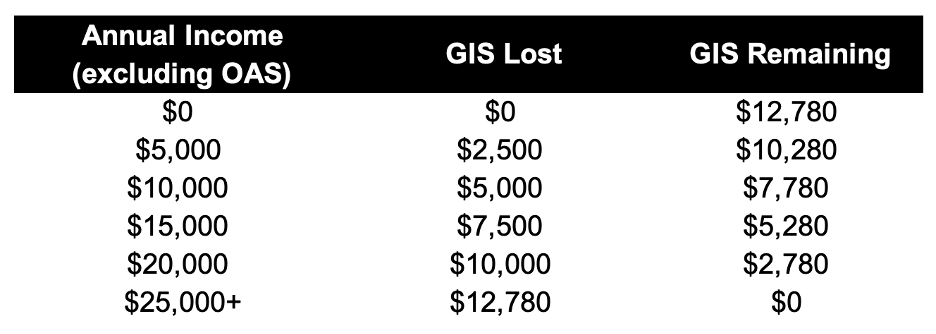

OAS Clawback (Recovery Tax) Table

Old Age Security is reduced once net income exceeds ~$90,000 (2025). The clawback rate is 15% of income above that threshold, until OAS is fully eliminated.

Canada Pension Plan (CPP)

CPP is based on your contributions during your working years. You and your employer each contribute a percentage of your earnings towards CPP (self-employed contribute both portions). CPP has a flexible start date, but your starting age has an impact on much income you will receive over the course of your retirement.

Key facts:

-

- Eligibility:

-

- You must apply to get CPP. CPP does not start automatically.

-

- Start age:

-

- As early as 60, as late as 70. The standard age is 65.

-

- Amount:

-

- The maximum monthly benefit at 65 in 2025 is about $1,364, but the average is closer to $758 (since few people contribute at maximum levels for their entire career).

-

- Eligibility:

Guaranteed Income Supplement (GIS)

GIS is an top-up benefit for low-income seniors. It’s meant to ensure a minimum standard of living for Canadians who rely mostly on government programs. GIS provides crucial support for low-income retirees but is extremely sensitive to additional income.

Key facts:

-

-

- Eligibility:

- You must be receiving OAS and have low annual income.

- Automatic?

- Generally, yes, if you file taxes.

- Amount (2025):

- Up to about $1,065/month for a single senior, less for couples.

- Income-tested:

- Every dollar of income above a low threshold (excluding OAS itself) reduces GIS. Even modest RRSP withdrawals or capital gains can eliminate it.

- Eligibility:

-

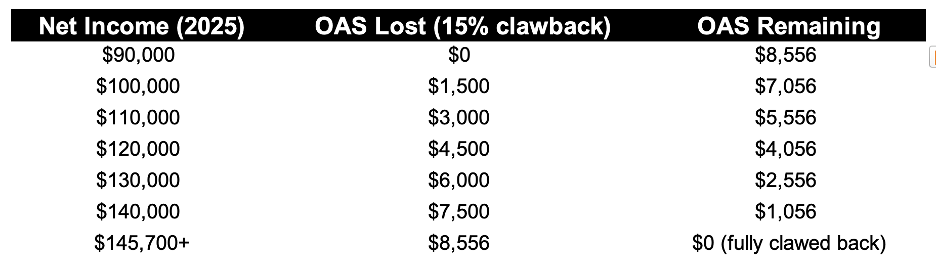

GIS Reduction Table

-

- GIS is available only if you are already receiving OAS.

- The maximum GIS (2025) for a single senior is about $12,780 per year (~$1,065/month).

- Every dollar of income above a very low threshold reduces GIS — often at rates close to 50 cents per dollar.

Deciding When to Start CPP: Early, On Time, or Delay?

One of the biggest retirement questions is: When should you start CPP?

Starting Early (as early as 60)

Pros:

-

- You get money sooner, which can help bridge retirement before OAS at 65.

- If you have health concerns or shorter life expectancy, starting early ensures you receive benefits

Cons:

-

- Permanent reduction in retirement benefits if started at 60

- You will get less income later, when costs (like healthcare) may rise.

Starting at 65 (standard)

Pros:

-

- Balanced approach. There is no reduction, no enhancement.

- Works well if you plan a “traditional retirement” at 65.

- Pairs naturally with OAS starting at the same age.

Cons:

-

- If you stop working at 60–64, you may need to rely on RRSPs, TFSAs, or bridge pensions until OAS and CPP kick in at age 65

Delaying to 70

Pros:

-

- Up to 42% higher lifetime benefit

- Inflation-protected and lasts for life. This is a helpful insurance cushion against outliving savings.

- Reduces the need for large RRSP withdrawals later.

Cons:

-

- You must fund retirement from other sources until 70.

- If you don’t live long enough, you may never “break even” on the delay.

- Requires careful planning with RRSPs and OAS to avoid clawbacks.

Key Considerations for Your Retirement Plan

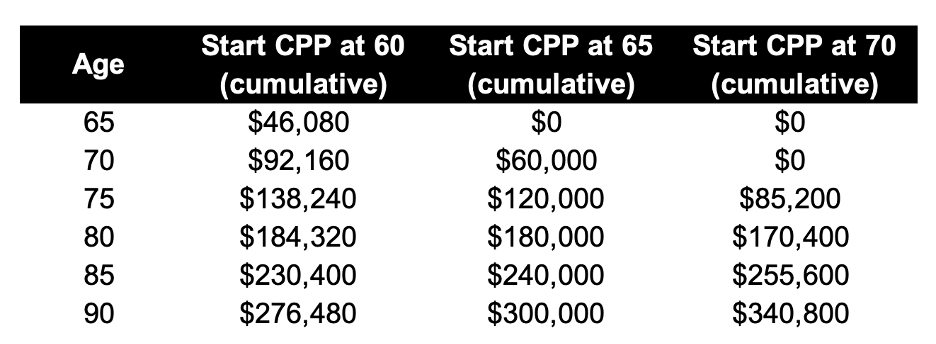

- Longevity: If you expect a long retirement (family history of living into the 90s), delaying CPP often pays off.

- Health: If your health is poor, taking CPP early may be wise.

- Other income sources: If you have substantial RRSPs or pensions, delaying CPP creates higher guaranteed income later.

- Benefit interactions: Starting CPP early may reduce GIS eligibility for low-income retirees.

CPP Breakeven Example: Start at 60, 65, or 70

Let’s assume the standard CPP benefit at age 65 is $1,000/month ($12,000/year).

- Start at 60: Reduced by 36% → $768/month ($9,216/year).

- Start at 65: Standard → $1,000/month ($12,000/year).

- Start at 70: Increased by 42% → $1,420/month ($17,040/year).

Conclusion

OAS, CPP, and GIS form the backbone of retirement income in Canada, but they’re not one-size-fits-all.

-

- OAS is universal but clawed back for high incomes.

- CPP is flexible, with lifelong consequences depending on your start age.

- GIS provides critical support but is highly income-sensitive.

Your decisions about when to start CPP, how to manage RRSP withdrawals, and how much income to draw each year can have a huge impact on your lifetime tax and benefit picture. With proper planning, you can maximize these government programs while preserving your personal savings.

Would you like to discuss how to maximize your retirement benefits? Get in touch with us here or sign up to get more accounting and tax tips in our newsletter here.

The accounting and tax information provided in this post does not constitute advice and is meant to be for general information purposes only. The information is current as at the date of this post and does not reflect any changes in accounting and/or tax legislation thereafter. Moreover, the information has been prepared without considering your company or personal financial/tax circumstances and/or objectives.