Investment Income inside a Corporation (Part 2 of 2): Advanced Tax Planning Strategies

Tax Planning

Investment Income inside a Corporation (Part 2 of 2): Advanced Tax Planning Strategies

Ali Ladha, CPA, CA / August 11, 2025

In Part 1, we laid the groundwork on how different types of investment income are taxed inside a Canadian corporation.

Now, in Part 2, we’ll dive into strategic planning opportunities available to business owners and investors who want to optimize tax efficiency, recover refundable taxes, and preserve the Small Business Deduction (SBD).

RDTOH: Refundable Dividend Tax on Hand

The RDTOH system ensures tax integration by allowing corporations to recover a portion of the high tax they pay on passive income when dividends are paid to shareholders.

How does RDTOH Work?

When a CCPC earns investment income, it pays high tax rates. As specified in Part 1 there are two levels of tax on investment income, a permanent tax and a refundable tax

-

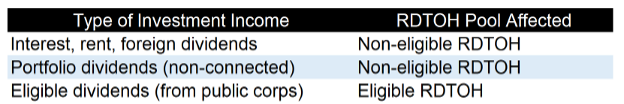

- The refundable portion of the tax goes into one of two RDTOH pools:

- Eligible RDTOH (for eligible dividends received)

- Non-eligible RDTOH (for most other passive income)

- When the corporation pays dividends to its shareholders, it receives a refund from the RDTOH pools based on the following rule:

-

- $1 of refundable tax for every $3 of dividends paid

-

Why are there two RDTOH pools?

Because each pool is used to track investment income based on the source that it is earned. For what it’s worth, eligible dividends which go into the ERDTOH pool have a temporary tax of 38.33% which is fully refundable when you pay eligible dividends.

On the other hand, investment income earned that ends up in the Non-Eligible RDTOH pool has a permanent tax of 20% and a temporary tax of 30.67% which is fully refundable when you pay non-eligible dividends.

Strategic Planning Tips

-

- Match dividends to the RDTOH pool: For example, don’t pay eligible dividends if you only have non-eligible RDTOH

- Year-end dividend planning: Pay out sufficient dividends before year-end to trigger the refund and reduce corporate tax liability

- Optimize for cash flow: If the shareholder is in a lower tax bracket (e.g., retired spouse), paying dividends to recover RDTOH can be highly efficient

A Practical Example

ABC Inc. earns $100,000 of interest income. It pays ~$50,170 in tax, including ~$10,200 to the non-eligible RDTOH account.

If it declares and pays $30,600 in non-eligible dividends, it triggers a $10,200 tax refund resulting in an effective tax rate closer to personal integration levels.

RDTOH Sequencing Rules

Per the Income Tax Act and CRA guidance:

-

- Eligible dividends → Refunds only come from ERDTOH.

NERDTOH is untouched.

- Eligible dividends → Refunds only come from ERDTOH.

-

- Non-eligible dividends → Refunds come from NERDTOH first, and only if there’s more refund capacity than NERDTOH allows will the balance be drawn from ERDTOH.

Example 1: Paying a Non-Eligible Dividend

Facts:

-

- ERDTOH = $15,000

- NERDTOH = $25,000

- Dividend paid: $90,000 (non-eligible)

Refund:

-

- Potential refund = $90,000 ÷ 3 = $30,000

- First draw from NERDTOH → $25,000 refund (NERDTOH now $0)

- Remaining refund capacity = $5,000 → Draw from ERDTOH (ERDTOH now $10,000)

Result:

-

- Refund received = $30,000 total

- ERDTOH still has $10,000 remaining.

Example 2: Paying an Eligible Dividend

Facts:

-

- ERDTOH = $15,000

- NERDTOH = $25,000

- Dividend paid: $45,000 (eligible)

Refund:

-

- Potential refund = $45,000 ÷ 3 = $15,000

- All refund comes from ERDTOH (NERDTOH untouched)

Result:

-

- Refund received = $15,000

- ERDTOH now $0, NERDTOH still $25,000.

Strategic Planning Tips

-

- Always check your RDTOH balances before declaring dividends

- If your goal is to clear NERDTOH, pay non-eligible dividends first

- If you want to access ERDTOH without touching NERDTOH, pay eligible dividends but confirm you have enough GRIP

- In mixed-pool situations, a non-eligible dividend will always drain NERDTOH first before touching ERDTOH

Preserving the Small Business Deduction (SBD)

What Is the Small Business Deduction?

The Small Business Deduction (SBD) is one of the most valuable tax advantages available to Canadian-controlled private corporations (CCPCs). It reduces the federal corporate tax rate on active business income (ABI) from the general rate (~15%) to the small business rate of 9%. When combined with provincial rates, this means active income up to $500,000 can be taxed as low as 11–13%, depending on the province.

How Passive Income Reduces the Small Business Deduction (SBD) Limit

The Small Business Deduction lowers the federal tax rate on active business income to 9% (plus provincial rates). But passive income over $50,000 can reduce or eliminate this benefit.

The AAII Grind

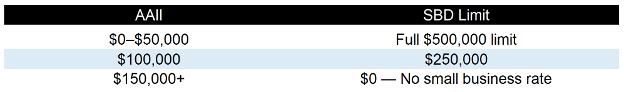

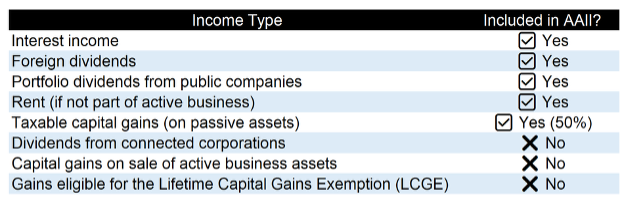

CRA uses Adjusted Aggregate Investment Income (AAII) to determine if the SBD should be reduced.

For every $1 above $50,000, the corporation’s SBD limit shrinks by $5. The SBD is fully eliminated at $150,000 of AAII.

What Counts Toward AAII?

The CRA defines AAII as most types of passive investment income, including:

Strategic Planning to Preserve the Small Business Deduction (SBD) Limit

If your corporation earns passive income, use the following strategies to keep AAII below the $50,000 threshold or at least minimize the impact of the grind.

- Use Capital Gains Over Interest or Rent

Capital gains are only 50% included in AAII, whereas interest, rent, and foreign dividends are fully included.

-

-

- $100,000 in capital gains = $50,000 in AAII, right at the threshold

- $100,000 in interest = $100,000 in AAII, resulting in a $250K SBD reduction

-

Tip: Favor growth-oriented investments over yield-heavy ones. Rebalance portfolios to lean on capital appreciation.

- Use Corporate-Owned Life Insurance

The cash value growth inside corporate-owned life insurance policies is not included in AAII making it a powerful long-term tax shelter.

-

-

- No tax on growth

- No impact on SBD

- Death benefit adds to Capital Dividend Account (CDA)

-

This strategy is especially valuable for corporations that already have significant retained earnings and want tax-exempt growth.

- Use a Holding Company (HoldCo) Wisely

Creating a holding company structure can sometimes help isolate investment income from your active business corporation (OpCo), though it’s not a silver bullet.

The SBD grind applies at the group level, meaning that AAII from associated corporations is aggregated.

To be effective, the HoldCo must not be associated which requires careful ownership structuring, potentially involving a spouse or adult children via a family trust.

- Defer Investment Income or Capital Gains

In some years, it may make sense to:

-

-

- Defer the sale of appreciated assets

- Trigger gains in lower-income years

- Smooth income to stay under the threshold

-

This requires long-term planning and coordination with your portfolio advisor and accountant, especially before corporate year-end.

- Consider an Individual Pension Plan (IPP)

An IPP is a defined benefit pension plan that can be set up by the corporation for the business owner. Contributions:

-

-

- Are corporate tax deductions

- Do not generate passive income

- Reduce retained earnings without triggering AAII

-

An excellent tool for late-career business owners who want retirement savings + SBD preservation.

Do you need with calculating tax on investment income in a corporation or have any questions? Let us help you. Get in touch with us here or sign up to get more accounting and tax tips in our newsletter here.

The accounting and tax information provided in this post does not constitute advice and is meant to be for general information purposes only. The information is current as at the date of this post and does not reflect any changes in accounting and/or tax legislation thereafter. Moreover, the information has been prepared without considering your company or personal financial/tax circumstances and/or objectives.